Sam Ginger

Sustainable Business Specialist

Before I started working in conservation, my university studies taught me that the long-term protection and restoration of ecosystems are dependent on a huge number of factors; community participation, legal frameworks, effective management and monitoring, and public awareness campaigns to name a few. One factor that I rarely considered was the influence of business.

After joining the Sustainable Business and Finance team at ZSL I saw firsthand how businesses can employ entire communities, build vital infrastructure, influence government policy, and be granted licences to large areas of land. On paper, business impacts can be hugely positive, such as developing rural economies and improving community well-being and career opportunities. Once driving around a Malaysian city, it was pointed out to me the large number of buildings the local timber company had constructed. However, the impacts can also be negative.

Many of us will remember headlines from when businesses have got it wrong; the DuPont & 3M Forever Chemicals scandals, Exxon’s concealment of climate change research, and VW’s emissions scandal. In response, whole industries have had to work hard to rebuild shareholder confidence and public trust by committing to do better and not repeat their mistakes. But how robust are these commitments? And are companies following through, or is it all a lot of hot air?

Five years of SPOTT assessment of natural rubber companies: What have we learned?

At ZSL, I work as a lead analyst for our SPOTT initiative. This free online tool tracks the public disclosures of environment, social, and governance (ESG) information by some of the world’s most influential companies. Using the SPOTT indicator framework, we assess the producers, processors and traders of palm oil, timber, pulp, and natural rubber – some of the soft commodities known for their role in driving global deforestation.

This year, we have undertaken our fifth annual benchmarking of the natural rubber sector. With this long-term data collection, we’re able to see more clearly where businesses have been focussing their sustainability efforts, where they are missing the mark, and hypothesise where we’ll see the biggest improvements in the next five years.

Left: Natural rubber is extracted as liquid latex from rubber trees (Hevea brasiliensis). Right: Around 70% of global natural rubber is used to manufacture tyres.

Enhanced sustainability reporting

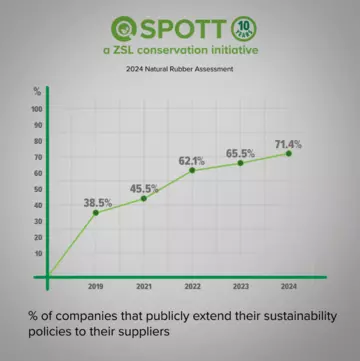

Firstly, the publication of comprehensive sustainability policies has increased across the rubber sector. Because of these policies, most companies have now laid the groundwork for eliminating deforestation, human and workers’ rights abuses and reducing GHG emissions. In 2019 just 39% had comprehensive sustainability policies covering their supply chains, this year, it's 71.4%. This trend has been boosted by the adoption of the Global Platform for Sustainable Natural Rubber's (GPSNR) Policy Framework by 18 of the 30 assessed companies.

How GPSNR works to advance sustainability in the rubber sector

GPSNR’s influence cannot be understated, its membership represents over half of global natural rubber sourcing and, as a result, its Policy Framework has formed the benchmark for sectoral sustainability. The platform is currently working on an assurance model to verify member implementation of sustainability commitments and enable members to make claims for their products. ZSL has been an active civil society voice within GPSNR, pushing the ambition of the platform, designing a due diligence system, and advocating for a robust assurance model to hold members to account and give legitimacy to the platform.

Policy publication vs policy implementation

Although policy disclosures have improved, there is a continued lack of publicly available information for SPOTT ‘organisation’ and ‘practice’ indicators – those covering evidence of policy implementation. For example, in 2024, despite 71.4% of companies publicly committing their suppliers to zero deforestation, only 17% report on how they monitor supplier plantations – meaning in the eyes of the public the vast majority of companies are doing nothing to combat deforestation embedded in their supply chains.

We are anticipating the sector will soon increase its publication of evidence as the landmark EU Regulation on Deforestation-Free Products (known as the EUDR) comes into force in 2025. The regulation mandates that all natural rubber entering the EU must be deforestation-free, traceable to the farm, and legally produced. Not only will companies now legally have to monitor supplier deforestation but there is also an unmissable opportunity for companies to tout their efforts to the public.

Our team is engaging with soft commodity companies, including rubber companies, to support their regulatory compliance, including EUDR. You can read more about how we are supporting the private sector through our advisory offering.

Climate change and risk to rubber companies

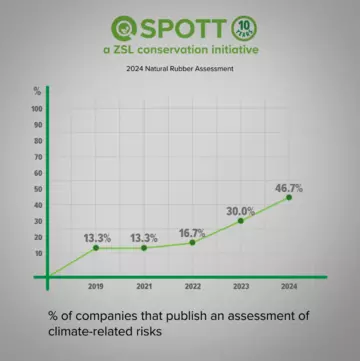

‘Extreme weather events’ and ‘Critical change to Earth systems’ may be the top two global risks according to the World Economic Forum, but most natural rubber companies have yet to publish a climate risk assessment. The whole supply chain is reliant on the cultivation of a crop which, in turn, is dependent on a stable climate. All companies must identify climate risks, and build adaptation and mitigation strategies, business as usual is not an option. In 2019 only 13.3% of companies had public climate risk assessments, now it's 46.7%.

The SPOTT framework accounts for advances in best practice and as a result, our ‘Landbank, maps, and traceability’ category has grown from 11 to 32 indicators within 5 years. Traceability indicators have become increasingly granular, the “Commitment to traceability of the whole supply chain” indicator in 2019 has been replaced by 18 indicators scoring on the availability of commitments to trace industrial plantation and smallholder supply, and the disclosure of supplier locations, volumes sourced, and traced.

Below, a sample of related indicators scoring on a public commitment to trace smallholder rubber and its implementation shows only marginal gains over three years – only a third of processors report the percentage of smallholder rubber they can trace back to a self-defined jurisdiction below country level. And just 5% of companies sourcing from processors report the percentage they can trace back to jurisdiction.

| SPOTT Indicator | 2022 | 2023 | 2024 |

| Time-bound commitment to achieve 100% traceability to jurisdictional level for smallholders? | 13.8% | 13.8% | 22.2% |

| Percentage of supply from own processing facilities traceable to smallholder at jurisdictional level | 6.9% | 15.0% | 33.3% |

| Percentage of supply from third-party processing facilities traceable to smallholders at jurisdictional level | 5.3% | 5.3% | 5.3% |

Challenges and opportunities for rubber companies in achieving traceability

A key barrier to progress for some disclosures is the perception of losing a competitive advantage to corporate rivals. Anecdotally, this is a major concern of companies when discussing disclosing the size and location of their operations, sourcing areas, and traceability of supply, despite the mounting pressure from the public, civil society, and governments (EUDR) to know where products come from. For rubber growers, this manifests in a lack of public geo-referenced plantation maps, since 2019 only 2 companies have disclosed maps that fully satisfy SPOTT criteria.

Left: Accurate GPS maps with clear plantation boundaries are fundamental pieces of data used by buyers to monitor key ESG risks such as deforestation. Right: Rubber tree plantation.

Companies that trace their rubber will realise the untapped potential of their suppliers and uncover opportunities to improve product quality and reduce negative and social impacts. For example, capacity-sharing with smallholders by training them on how to improve latex yield or exploring innovative price guarantees and premiums to improve smallholder livelihoods and also reduce conversion pressures on neighbouring forests. Full traceability of supply is the enabler of meaningful transformation to a climate-resilient, biodiverse, and equitable sector, without it the ability to fulfil sustainability commitments will be a continual struggle.

Watch our training video to equip yourself with the knowledge needed to navigate the evolving landscape of sustainability and risk mitigation in natural rubber production.

Future priorities for the natural rubber sector to advance sustainability

To conclude, we can see that the natural rubber sector has admirably improved its disclosure of sustainability policies and commitments, demonstrating its intentions to create a sector more considerate of people and planet.

However, the same degree of disclosure on actions to lessen the negative impacts of rubber production and trade hasn’t been seen. The sector needs to concentrate efforts on the ground and effectively communicate actions by following robust disclosure frameworks such as SPOTT.

Lastly, traceability is where we predict the sector will improve in the next five years, fuelled by the EUDR’s requirements, and this will open the door to better management of ESG risks, more meaningful supplier engagement, and greater sustainability gains for smallholder farmers and forests alike.

ZSL will continue to track the transparency of the sector over time and engage with companies to improve their sustainability disclosures. Whether companies are already assessed on our SPOTT platform or looking to enhance their practices, our team is equipped to guide and support them on their sustainability journey.

If you are a soft commodity company, get in touch with us for tailored guidance, training or support on sustainability and responsible sourcing.