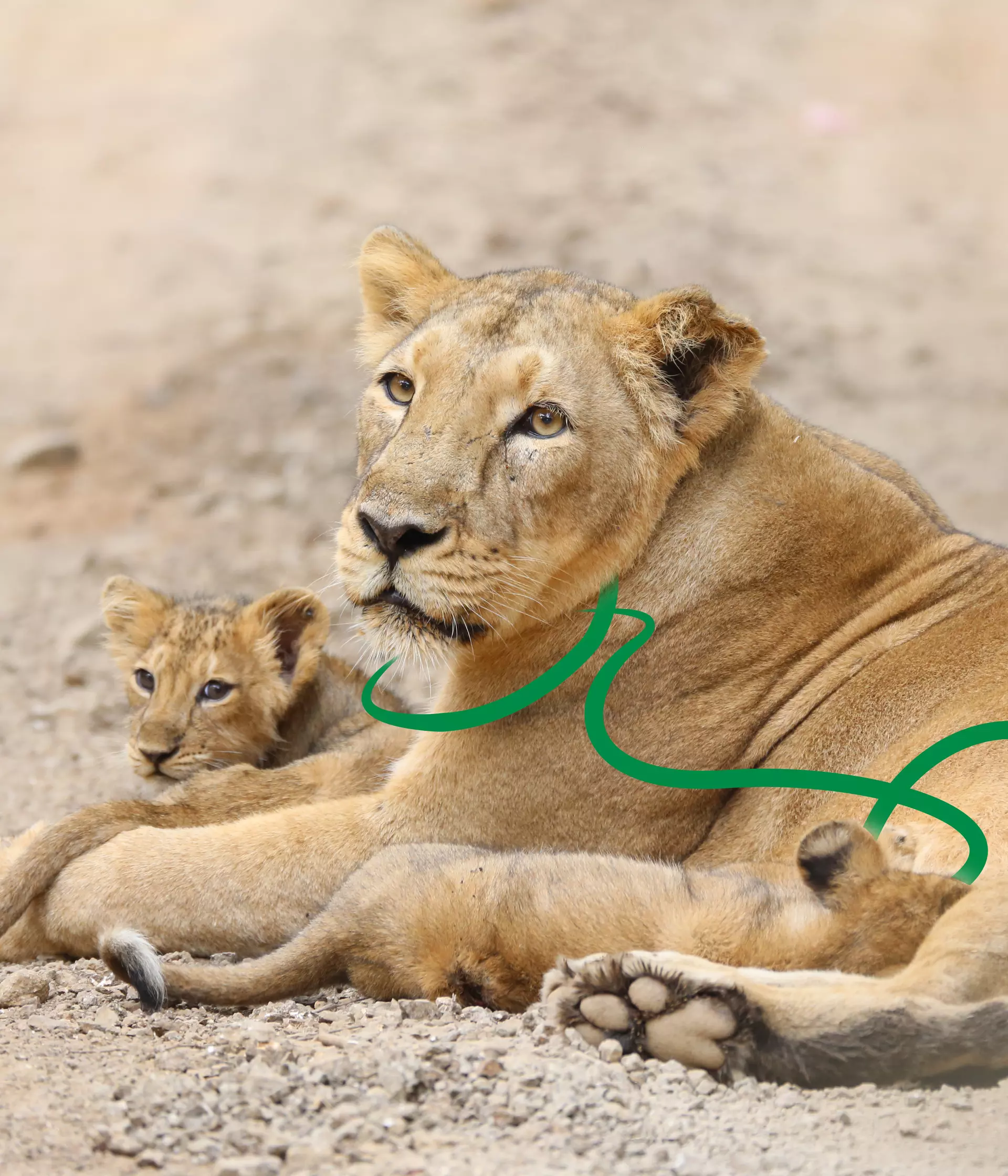

As a charity, we need your help to ensure a future for endangered wildlife. A gift to ZSL in your Will is one of the most powerful ways that you can support our natural world.

Every gift, no matter how large or small, will make a lasting and valued contribution to the work that we do to achieve positive change for the future of wildlife, people and planet. We are working around the world to support the mass recovery of wildlife. Working alongside local communities, our scientific research, reintroduction programmes, wildlife monitoring and animal health expertise helps species come back from the brink of extinction and flourish again.

At London and Whipsnade Zoos, we help to create lifelong connections with nature, inspiring and educating the next generation of conservationists. We understand that your family and loved ones come first, but we hope that, once you have provided for them, you will also remember ZSL.

We will use your gift with the greatest of care, in line with your wishes, to ensure that it makes a positive difference to the future of wildlife and our planet.

The natural world needs our support more than ever. Together, we can secure its future.

Thanking you

We also understand that your Will is private and we respect this - you don't even need to tell us that you intend to leave us a gift. However, if you do decide to include us in your Will you can help us to better plan for the future by letting us know. Importantly, it also means we can thank you for your incredibly generous support during your lifetime, inviting you to events and sharing updates about our global impact with you.

How you can support us

Gifts to ZSL without any restrictions are invaluable to us, enabling us to spend your gift where the need is greatest and helping us to plan for our future.

However, we warmly accept gifts for a particular use, for example helping to run our two Zoos, or to support our world-leading scientific research. If you would like a gift to help a particular area of work, please do get in touch so we can discuss your intentions and ensure your wishes are met.

One of our kind supporters, Delene Welch, an animal-loving former lawyer generously left London Zoo a legacy gift which helped us to improve areas of the Zoo, supporting our work to engage millions of people each year with the natural world. Delene, upon retiring, volunteered her free time at London, volunteering one day a week for 12 years. When she wrote her Will, she wanted more than anything to leave an enduring gift to the animals at the Zoo, leaving the bulk of her estate to be used 'for the benefit of animals' and divided the rest among friends, relatives and an animal home. Her incredible gift contributed to London Zoo's Rainforest Biome, Into Africa and Gorilla Kingdom.

Types of gifts you can leave ZSL in your Will

Leaving a gift to ZSL in your Will will make a lasting and valued contribution to the work we do, and it's easier than you may think.

When it comes to leaving a gift in to a charity in your Will, we like to think of the process consisting of in three straightforward steps:

- Make a decision on what type of gift you would like to give (this can be either a percentage of your entire estate, a fixed amount of money or a specific item).

We go into more detail on these below.

- Contact your solicitor or your preferred professional Will writing service.

- Provide the specific details on the gift you would like to give, with the specific charity number you would like to give the gift to.

We have provided suggested wording on how to add these gifts to your Will below.

What type of gift can I leave?

We typically receive two types of gift left to ZSL in Wills. These include a specific, or fixed amount of money which is known as a pecuniary gift and which is paid from your estate first. The second is a percentage or share of your estate, known as a residuary gift. A residue of your estate is the balance of your estate after tax, expenses and all other gifts in your Will have already been paid. It can be up to 100% but any percentage left to ZSL in your Will can make a real difference for wildlife.

You can see suggested wording for these types of gifts below, or you can print this guide and take it with you when you see your solicitor or professional Will writer.

We also benefit from other specific gifts, for example, personal possessions, land, buildings or shares. Please note however, that if a specific gift is no longer in your estate at the time of your death, the gift will fail.

We would recommend you use a qualified solicitor to discuss your Will, and they can advise you on which type of gift is best for you and your personal situation. If you do not have a solicitor already, you can find one by searching the STEP website or by using The Law Society's online database to find one in your area. Also, you may wish to ensure that your solicitor protects your gift by making sure it would still apply if ZSL were to change its name.

If you already have a Will that you are happy with but would like to include ZSL, you can write a codicil to add a gift to your existing Will. We recommend asking your solicitor or professional Will write to help you with this.

FREE WILLS SERVICE

Make Your Will for Free

The Guardian Angels Wills Service that ZSL uses to provide our supporters with Free Wills is rebranding, and changing its name to "Octopus". Please rest assured that they will provide the same excellent service and will still be run by the same team, so that when you decide to make your Will, you know you are using a trusted, reputable company, who have many years of experience in providing Wills in partnership with the charity sector.

You can make your Will either online, over the telephone, or at a face-to-face appointment, whichever option works for you.

To use the FREE WILL service, either click the link below and follow the online instructions, or you can make a phone or face-to-face appointment by calling Octopus on 0800 773 4014 and quoting “ZSL”.

By writing your Will and leaving a gift to ZSL in it, you will make a lasting and valued contribution to the work we do to achieve positive change for the future of wildlife, people, and planet. We work around the world to support the mass recovery of wildlife. Working alongside local communities, our scientific research, reintroduction programmes, wildlife monitoring and animal health expertise helps species come back from the brink of extinction and flourish again.

You aren’t obliged to leave a gift to ZSL in your Will, but we’d be truly grateful if you do. If you have left a gift in your Will, we’d love to hear from you. It isn’t a binding commitment, and all information will be held in the strictest confidence. Contact us at remember@zsl.org

Click the link below to go to the Octopus ZSL Free Wills webpage:

Inheritance Tax

Lots of people worry about inheritance tax, but the good news is that by leaving a gift to ZSL in your Will you could help to reduce, even remove, the tax burden on your estate.

Inheritance tax may be payable on the value of a person's estate when they pass away, if the value of the estate exceeds the inheritance tax threshold (known as the nil rate band) set by the Government. Currently the inheritance tax threshold remains frozen at £325,000, and any amount above this would be potentially taxed at a rate of 40% depending on who receives the estate.

UK-registered charities are exempt from inheritance tax, so a gift to your charity in your Will is tax-free, both for the charity and your estate. For example, if your estate is worth £10,000 more than the tax threshold and, assuming Inheritance Tax is payable on your estate is worth £10,000 more than the tax threshold, and assuming Inheritance Tax is payable on your estate and is at 40% (the current rate), at the time of your death there would be Inheritance Tax of £4,000 (40% of £10,000) to be paid out of the estate. But, if you made a cash gift to ZSL of £10,000, the notional value of your estate would be reduced by that amount and there would be no tax to pay.

Also, to encourage charitable giving, the rate of inheritance tax is reduced from 40% to 30% when at least 10% of the net estate is left to charity.

Inheritance tax is a complex issue and your solicitor or financial advisor can advise you on the best way to take advantage of any financial benefits that may be relevant to you and your estate, including changes to tax rates when including family members as recipients in your Will. As a charity, we cannot offer legal or tax advice, and we recommend speaking with your solicitor if you wish to make or update your Will.

Will Wording Guidance

If you or your client would like to include a gift in their Will to the Zoological Society of London (ZSL) for its general charitable purposes, please use the following wording:

A Gift of all or a share of Residuary Estate

“I give to the Zoological Society of London (ZSL), Regent's Park, London NW1 4RY (registered charity number 208728) all / _____% of the residue* of my estate absolutely for its general charitable purposes and I declare that the receipt of the Finance Director or other proper officer at ZSL for the time being shall be a sufficient discharge to my executor(s)”.

A Cash (pecuniary) Gift

“I give to the Zoological Society of London (ZSL), Regent's Park, London NW1 4RY (registered charity number 208728) the sum of £__________ (please specify words and figures) free of tax for its general charitable purposes and I declare that the receipt of the Finance Director or other proper officer at ZSL for the time being shall be a sufficient discharge to my executor(s)”.

A Specific Item

“I give to the Zoological Society of London (ZSL), Regent's Park, London NW1 4RY (registered charity number 208728) my ______________(specific item(s)) free of tax for its general charitable purposes and I declare that the receipt of the Finance Director or other proper officer at ZSL for the time being shall be a sufficient discharge to my executor(s)”.

Gifts which are left to fund a particular area of our work, research or specific project:

A Gift of all, or a share of the Residuary Estate

“I give to the Zoological Society of London (ZSL), Regent's Park, London NW1 4RY (registered charity number 208728) all/_____% of the residue* of my estate with the wish, but without imposing a binding obligation, that the gift is used for [area of our work, e.g. ZSL London Zoo], and I declare that the receipt of the Finance Director or other proper officer at ZSL for the time being shall be a sufficient discharge to my executor(s)”.

*please delete as appropriate

A Cash (pecuniary) Gift

“I give to the Zoological Society of London (ZSL), Regent's Park, London NW1 4RY (registered charity number 208728) the sum of £__________ (please specify words and figures) free of tax, with the wish, but without imposing a binding obligation, that the gift is used for [area of our work, e.g. ZSL London Zoo], and I declare that the receipt of the Finance Director or other proper officer at ZSL for the time being shall be a sufficient discharge to my executor(s)”.

A Specific Item

“I give to the Zoological Society of London (ZSL), Regent's Park, London NW1 4RY (registered charity number 208728) my ______________(specific item(s)) free of tax, with the wish, but without imposing a binding obligation, that the gift is used for [area of our work, e.g. ZSL London Zoo], and I declare that the receipt of the Finance Director or other proper officer at ZSL for the time being shall be a sufficient discharge to my executor(s)”.

Clause to prevent lapsed Charity Gift

To be used in all Wills which incorporate a gift (or gifts) to a charity (or charities) – this clause will prevent the gift becoming void (and thus failing) if the original charity has either merged with another or ceased to exist. It gives the executors of the Will the power to apply the gift to the merged organisation, or to another charity which has the same (or broadly similar) aims.

“If at the date of my death the Zoological Society of London Registered Charity Number208728 (the ‘Charity’) has amalgamated with another charity or transferred its assets to another body, or otherwise ceased to exist, then, in the absence of an expression of wishes of the testator, the executors of my will shall give effect to any gift made to the Charity as if it had been made to the Charity in its changed form (following the amalgamation or transfer) or, if this is not possible, to such charitable organisation as they consider most closely fulfils the objectives of the Charity [preferably one associated with Zoological Society of London]. The receipt of the treasurer or other appropriate officer for the time being of the Charity, or of any substituted charity to which the legacy is paid, shall be sufficient to discharge the executors of my will”.

Saving Inheritance Tax – 10% of your estate to Charity

Gifts left to UK charities are free of inheritance tax liability. However, if you wish to make a gift to a charity outside the UK, the situation is more complex. Not only are charitable gifts tax-free but leaving gifts to charity in your will could mitigate your tax liability overall. When you leave at least 10% of your estate to charity, the inheritance tax liability of the rest of your estate falls to 36%.

Leaving the minimum amount to charity required to qualify for the reduced rate of inheritance tax under Schedule 1A Inheritance Tax Act 1984

“1.1 I give Zoological Society of London of Regent's Park, London, England NW1 4RY Registered Charity Number 208728 such a sum as together with any other gifts to charity made under my will or any codicil shall constitute a donated amount equal to ten per cent (10%) of the baseline amount in relation to the general component of my estate.

1.2 If relief under Schedule 1A Inheritance Tax Act 1984 (IHTA) shall have been abolished at the time of my death or if inheritance tax shall have been abolished at that time this legacy shall instead of the amount specified in clause 1.1 above be a sum equal to [ ] per cent ([]%) of the residue of my estate.

1.3 My executors in making payment of the legacy given by this clause:

1.3.1 shall be entitled to accept in full discharge the receipt of the secretary, treasurer or other officer of the charity concerned

1.3.2 may appropriate assets not otherwise specifically bequeathed to satisfy (or partly satisfy) this legacy without the consent of any beneficiary under my will or any codicil.

1.4 I hereby confer on my executors the power in their absolute discretion to make or withdraw an election under paragraph 7 of Schedule 1A IHTA in relation to any other eligible part of my estate whether or not the general component is the qualifying component and to make or withdraw an election under paragraph 8 of that Schedule.

1.5 Terms in this clause have the same meaning as in Schedule 1A IHTA and the reference to a gift to charity means a gift attributable to property to which section 23 IHTA applies.

1.6 [The legacy given by this clause shall in no event:

1.6.1 be less than £[●] whether or not the lower rate of tax shall be applicable; and

1.6.2 exceed £[●] (the upper limit) even if in consequence of this restriction in the value of this legacy the lower rate of tax shall not apply. [If this proviso shall apply and in consequence the lower rate of tax shall not be applicable the amount of this legacy shall [be equal to the amount of the upper limit] [be reduced to £[●]] [lapse].]”